Article Excerpt

Why do we pay property taxes? How often are they due? Do you have to pay forever? Why do they go up? When do you start paying them? We’ll answer these questions and more.

Property taxes: love ‘em or hate ‘em, they’re part of being a homeowner. They’re one of the four parts of a mortgage payment: principal, interest, taxes, and insurance.

What are property taxes used for?

The first obvious question for any new homeowner is “why do we pay property tax?” Especially since the home is all yours - right? The home is your property, but your local government still wants you to pay them for owning it. There are differing opinions about property taxes, but that’s the fact of the matter.

Property taxes are used for many things in your local community:

- Schools: teacher salaries, equipment, building upkeep, renovations, extracurricular activities, etc.

- Streets: developing new roads, repairing roads, cleaning roads, etc.

- Police and Fire: police and firefighter salaries, training, vehicle upkeep, etc.

- Special districts: hospitals, junior colleges, water districts, local parks and recreation, etc.

Voters approved McKinney ISD’s $69.9M football stadium project in 2016. Unfortunately, problems with cracks in its concrete inflated its final price tag even larger.

How do property tax payments work when you buy a house?

Whether you pay toward property taxes each month through a mortgage escrow account or just once-yearly directly to your local government is a choice you’ll make. Most homeowners set up an escrow account.

Escrow accounts are free to use. They estimate how much this year’s property taxes will be, divide it into monthly parts, and withdraw that amount from your bank account every month. The advantage of a mortgage escrow account for taxes and insurance is that you won’t be responsible for remembering when taxes are due, calculating how much they are, or budgeting for them every month. It’s all automatic!

Escrow accounts are even more useful for investors with multiple properties. For example, We Buy Houses in Denver, a professional homebuyer in Colorado, stated that “Automating small tasks, like paying property taxes and insurance, frees up my headspace dramatically. I’m able to buy more houses throughout the year since I’m not weighed down by all the minor details, like when to pay taxes.”

» READ MORE: What’s a Mortgage Escrow Account? Do I Need One?

Do you pay property taxes monthly or yearly?

The simple answer: your property taxes are due once yearly. However, your mortgage payments may have you pay toward property taxes every month. Your lender will make the official once-yearly payment on your behalf with the funds they’ve collected from you.

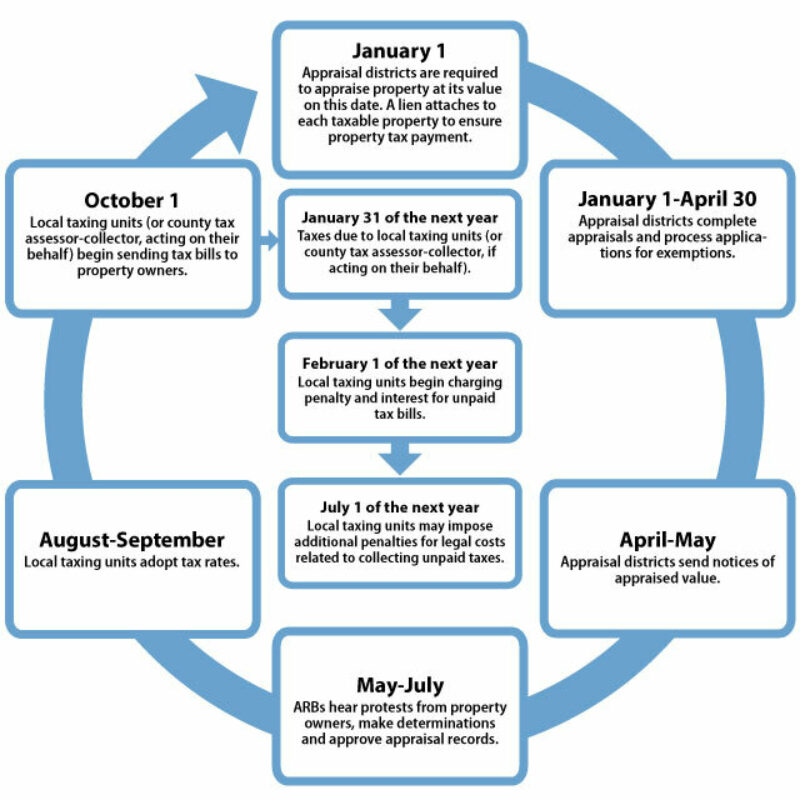

Find more information on comptroller.texas.gov

Do you have to pay property taxes forever?

The simple answer: yes. Property taxes don’t stop after your house is paid off or even if a homeowner passes away.

After your house is 100% paid off, you still have to pay property taxes. And since you no longer have a mortgage (and no mortgage escrow account) you will pay directly to your local government. If a homeowner passes away, their local taxing authority will continue assessing their property taxes. If the taxes remain unpaid for too long, a new lien may be created - or, the property will foreclose.

When do you start paying property taxes on your new home?

The simple answer: you’ll typically pay at least three months’-worth of property taxes at closing. That means you pay a portion of property taxes before moving into your home.

The person who sells the property to you will pay a prorated amount for the property taxes they were responsible for that year before you bought the home. So if your closing day is on July 1, your seller will pay for six months’-worth of property taxes, and you'll pay at least three months of property taxes in advance.

Why do property taxes go up?

The simple answer: property taxes may go up because your property increases in value or your local government wants to fund new projects.

- Converting a garage into a second living room would increase your livable square footage, making the home more valuable to buyers. Your taxing authority knows this and taxes you accordingly.

- Your home may be reevaluated. Periodic reevaluations ensure taxes are spread fairly across the community.

- Comparable homes near you may sell for higher prices. The price at which similar homes sell helps inform how much yours is worth.

- New community projects like school renovations and new parks may drive up your tax rate.

Understanding the difference between tax rates and home value

Your home value is how much your home is currently worth. The tax rate is a percentage of your home value. Even if your tax rate remains the same next year, you still may owe more property taxes if the value of your home increased.

Let’s say your home was worth $200,000 last year and the tax rate was 2%. You owed $4,000 last year in property taxes. This year, your tax rate stays the same at 2% but your home is now assessed to be worth $215,000. That means you’ll owe $4,300 this year.

Property tax example

If you look up your own property tax rate, you’ll see several different rates. Check out this example of an entire apartment complex’s property tax breakdown. There are taxes owed for a local community college campus, city taxes, a specific area in the city of Round Rock called Upper Brushy Creek, and some taxes at the county level.

|

Tax Description |

Assessed Value |

x Tax Rate |

= Tax Amount |

|---|---|---|---|

Austin Community College |

$31,045,080 |

0.1058% |

$32,845.69 |

Round Rock |

$31,045,080 |

0.4390% |

$135,287.90 |

Round Rock |

$31,045,080 |

1.2212% |

$379,122.52 |

Upper Brushy Creek WCID |

$31,045,080 |

0.0200% |

$6,209.02 |

Williamson County (Local Opt FRZ) |

$31,045,080 |

0.4187% |

$129,991.65 |

Williamson County FM/RD (Local Opt FRZ) |

$31,045,080 |

0.0400% |

$12,418.03 |

Property tax |

$31,045,080 |

x 2.2447 |

= $696,875 |

If you’re renting, you’re still feeling the effects of property taxes. You’re just paying (probably overpaying) someone else’s!

Got questions about property taxes?

Our local mortgage advisers have answers! Taxes are a major part of your expenses. Let’s figure out how much your total monthly mortgage would be. Your very first step is to answer a few quick questions here on our website.