Article Excerpt

If you're looking to borrow more than the conforming loan limit allows, a jumbo loan or second lien may be your ways forward. Let's see how they work.

Jumbo loans, or “non-conforming” loans, help homebuyers when they need to borrow more than $548,250. That doesn’t mean that you have to use a jumbo loan if the home’s purchase price is over $548,250. It’s all about the loan amount. So, if your home’s purchase price is $640,000 and you make a down payment of $100,000, you won’t need to use a jumbo loan.

The FHA loan program and conventional loans are examples of conforming loans. The conforming loan limit may change each year, as it did in 2020. From 2019 to 2020, the limit increased by $26,050. Every county in Texas has a conforming loan limit of $548,250 in 2021.

Every county in Texas has a conforming loan limit of $548,250 in 2021.

If you’re a US veteran, active service member, or surviving spouse looking to borrow more than $548,250, check out the VA home loan program. VA loans no longer feature a loan limit. But if you’re not a veteran and looking to borrow beyond the conforming loan limit - read on!

Eligibility Requirements for Jumbo Loans

The underwriting guidelines for jumbo loans are usually more stringent than non-jumbo loans. Qualifying for a jumbo loan may differ from a conventional in several ways:

- Higher down payment (typically 5-20% depending on the loan amount)

- Higher minimum credit score (typically above 700)

- More cash reserves needed (up to a full year’s worth of mortgage payments)

- More income documentation may be required (up to two years of tax returns, W2’s, 1099’s, etc.)

Interest rates and closing costs on a jumbo loan may differ from conforming loans as well. They may be higher since the government doesn’t insure jumbo loans and private investors have to take on the risk of lending to you. They may be lower if you have a strong borrower profile and are borrowing larger amounts.

Jumbo Loan Limits

First, understand that jumbo loan limits are decided by private investors. One lender may be able to lend more than another. Some lenders can offer millions.

Get started on a free pre-approval to see what you qualify for.

Get StartedSecond Liens

Getting a second lien (also called a second mortgage or second trust loan) may help you avoid the tough jumbo loan eligibility requirements. If you don’t have the cash reserves necessary to qualify or if your credit score is lacking, a second lien may be the right answer.

80-10-10 or “Piggyback” Loans

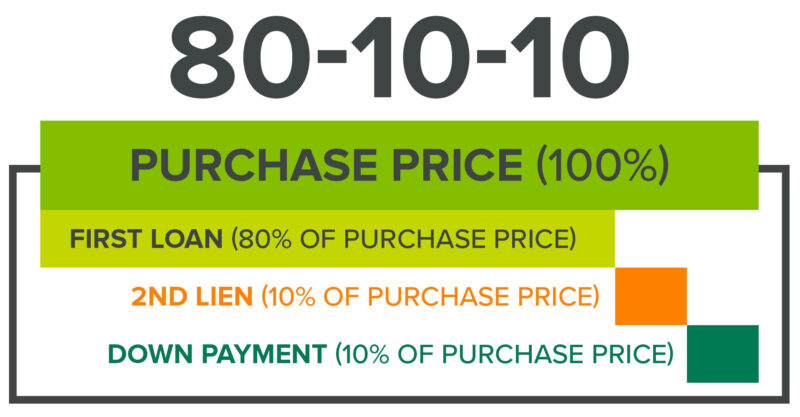

One way to structure your second lien is with the 80-10-10 format. The main purpose is to avoid being forced into a jumbo loan’s guidelines by taking two loans and making a down payment. This ensures that neither loan exceeds the conforming limit.

In an 80-10-10, you finance 80% of the home, put 10% down, and finance the remaining 10% as a piggyback loan.

80-10-10 Mortgage Example

The problem

Let’s say you want to purchase a $620,000 home in Texas. The conforming loan limit is $548,250, so you consider two options: get a jumbo loan or get a second lien. But you don’t have enough cash in reserves to qualify for a jumbo. Your credit score doesn’t meet what your lender requires either.

Cash reserves may include savings accounts, stock/bond investments, CD’s, money in retirement accounts, and more. Investors may differ on what they count toward cash reserves.

The solution

In order to sidestep jumbo loan terms, you need a way to avoid borrowing more than $548,250 in a single loan.

First, you take a loan for $496,000, which is 80% of your purchase price of $620,000. Now you're able to avoid being forced into jumbo terms since $496,000 is below the conforming loan limit.

But In order to avoid making the full 20% down payment, you get a second loan for $62,000, which is 10% of the purchase price. Then you make the down payment of $62,000, which is the other 10% of the purchase price.

That’s how an 80-10-10 helps luxury homebuyers avoid being forced into a jumbo loan. There are other structures, too - like a 75-15-10. Your loan officer will help determine which option is best for you.

Does your brain hurt yet?

Each homebuyer is different and sometimes loan options can seem confusing. We want to answer your questions, no matter how simple you may think they are. Get started today with the mortgage lender Texans trust!