Article Excerpt

Learn about how mortgage amortization allows you to pay for your home with set monthly payments over time, with tax benefits!

Homeowners with mortgages make monthly payments to their mortgage lender. Only part of each monthly payment goes towards paying off the loan. The rest consists of interest paid to the lender.

The process of gradually paying off a loan with regular payments is known as “amortization.” Amortization helps homebuyers by allowing them to make affordable, consistent payments on their mortgages.

What is amortization?

Mortgage amortization is a repayment feature on loans in which, at first, you pay more toward interest than principal each month. Eventually, usually around the halfway point of the loan term, you will pay more toward principal than interest.

Let’s define a couple more key terms:

Principal: This is the amount of money owed to a mortgage lender. As you make payments, the amount of principal goes down. When it reaches zero, the loan is paid in full.

Interest: This is the fee you pay to a lender for allowing you to borrow their money.

If you rent a car, you pay a fee to the rental car company in exchange for using the car for a specific period of time. If you do not return the car on time, you will face penalties. In this analogy, the money you borrow to buy a home is the rental car, and the interest is the rental fee.

One key difference between mortgages and rental cars is that rental companies charge their fee all at once, while mortgage lenders spread the fee out over the entire length of the loan.

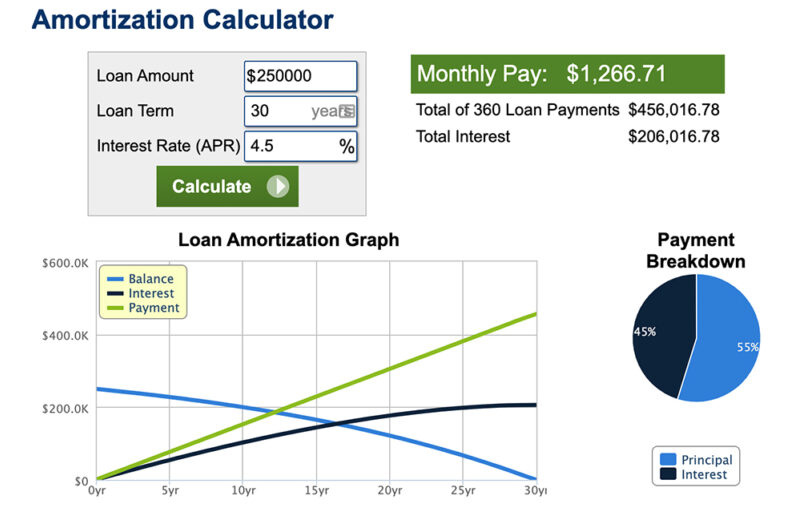

Image via calculator.net

Example

Suppose you take out a $250,000 mortgage loan to purchase a home. The loan has a thirty-year term and a fixed interest rate of 4.5 percent. Your monthly mortgage payment would be about $1,267.00. Part of that amount consists of interest paid to the lender. The rest goes to pay down the principal of the loan.

That 4.5 percent interest rate is an annual figure. Each month, you are only responsible for one-twelfth of that rate, or 0.375 percent. Your first month of interest would therefore be $937.50 ($250,000 x 0.375%). Remember, though, that you are paying the lender $1,267.00. The rest of the payment, $329.50, goes towards the principal of the loan.

|

Month |

Beginning Balance |

Interest |

Principal |

Ending Balance |

|---|---|---|---|---|

1 |

$250,000.00 |

$937.50 |

$329.21 |

$249,670.79 |

2 |

$249.670.79 |

$936.27 |

$330.44 |

$249,340.34 |

3 |

$249.340.34 |

$935.03 |

$331.68 |

$249,008.65 |

4 |

$249,008.65 |

$933.78 |

$332.93 |

$248,675.72 |

5 |

$248,675.72 |

$932.53 |

$334.18 |

$248,341.54 |

6 |

$248,341.54 |

$931.28 |

$335.43 |

$248,006.11 |

7 |

$248,006.11 |

$930.02 |

$336.69 |

$247,331.47 |

8 |

$247,331.47 |

$928.76 |

$337.95 |

$247,331.47 |

9 |

$247,331.47 |

$927.49 |

$339.22 |

$246,992.25 |

10 |

$246,992.25 |

$926.22 |

$340.49 |

$246,651.75 |

11 |

$246,651.75 |

$924.94 |

$341.77 |

$246,309.98 |

12 |

$246,309.98 |

$923.66 |

$343.05 |

$245,966.93 |

year 1 end |

||||

Now you only owe the lender $249,670.50. The amount of interest you owe for the second month will be less than what you paid the first month. As the principal balance of the loan goes down, the amount of each payment applied to the principal goes up. Eventually, more than half of your monthly payment will be principal instead of interest. At the end of thirty years, your final payment will only include a few dollars of interest. Lenders often provide charts, known as amortization schedules, showing the composition of each monthly payment.

|

Month |

Beginning Balance |

Interest |

Principal |

Ending Balance |

|---|---|---|---|---|

349 |

$14,836.44 |

$55.64 |

$1,211.07 |

$13,625.36 |

350 |

$13,625.36 |

$51.10 |

$1,215.61 |

$12,409.74 |

351 |

$12,409.74 |

$46.54 |

$1,220.17 |

$11,189.57 |

352 |

$11,189.57 |

$41.96 |

$1,224.75 |

$9,964.82 |

353 |

$9,964.82 |

$37.37 |

$1,229.34 |

$8,735.47 |

354 |

$8,735.47 |

$32.76 |

$1,233.95 |

$7,501.52 |

355 |

$7,501.52 |

$28.13 |

$1,238.58 |

$6,262.93 |

356 |

$6,262.93 |

$23.49 |

$1,243.22 |

$5,019.71 |

357 |

$5,019.71 |

$18.82 |

$1,247.89 |

$3,771.82 |

358 |

$3,771.82 |

$14.14 |

$1,252.57 |

$2,519.25 |

359 |

$2,519.25 |

$9.45 |

$1.,257.26 |

$1,261.98 |

360 |

$1,261.98 |

$4.73 |

$1,261.98 |

$0.00 |

year 30 end |

||||

Why are home loans amortized?

Amortization helps both borrowers and lenders. Borrowers usually want to pay off their loan as soon as they can. Lenders, on the other hand, make money by charging interest on loans. They are often more interested in receiving interest payments than in getting their money back.

With amortization, there is a specific period of time for the borrower to make payments. This allows the payments to remain within the borrower’s financial ability, and it guarantees interest income for the lender.

When do your payments “flip” to mostly principal?

You begin paying mostly principal around the middle of the mortgage loan term. For a thirty-year loan, it will probably happen at some point in the fourteenth or fifteenth year.

As a mortgage loan’s principal goes down, so does the monthly interest payment. The amount of each payment applied to the principal goes up. Eventually, the two components of the monthly payment will meet in the middle.

How does mortgage amortization affect homebuyers?

As mentioned above, amortization allows homebuyers to pay the same amount each month to their lender. It also offers tax benefits, since mortgage interest payments are tax-deductible. In the early years of a mortgage term, when the bulk of each payment goes towards interest, homeowners may have rather large deductions on their tax returns.

Is there a way to avoid amortization?

Loans do not have to be amortized but the alternatives are not favorable to homebuyers. With an interest-only loan, for example, the borrower only pays the interest on the principal, and then repays the entire principal at the end of the loan term. This might be possible for large businesses but not for most homeowners.

It is possible, however, to reduce the total amount of interest paid over the life of a loan. A long-term mortgage allows the borrower to pay a relatively small amount each month, but they will pay a substantial amount of interest over time. A shorter term means bigger monthly payments, but less interest.

The $250,000 mortgage with a thirty-year term mentioned above requires monthly payments of $1,267, but would eventually cost over $200,000 in interest. With a fifteen-year mortgage, that same loan amount would involve $1,912 monthly payments, and total interest of $94,000.

You could also save on interest by paying more to your lender each month. Instead of paying $1,267 your first month, suppose you pay $1,500. The amount of that payment applied to interest is still the same — 0.375 percent of $250,000 — but the rest goes towards the principal. Keep this up, and you could pay the mortgage off early.

Find out more.

Even with amortization, buying a home is still the smartest financial choice when compared to renting. The interest you pay to your lender is tax-deductible. Rent paid to a landlord is not. Get started on your free pre-approval today!