Article Excerpt

Hard inquiries lower your score. But you can stay safe within the mortgage credit pull window to minimize the effect of applying with multiple lenders.

You probably know that applying for new credit cards and smaller loans count as “hard inquiries” which put a temporary ding on your credit score. For these smaller lines of credit, you’re already aware of the perks they offer, so you don’t have to apply for too many.

But applying for a mortgage may seem riskier to your score because you want to compare lots of different companies within a short amount of time. Fortunately, credit bureaus seem to understand the need to shop around for a mortgage lender.

The Mortgage Credit Pull Window

The mortgage credit pull window is a grace period where multiple mortgage applications are believed to only count against your credit score as a single hard inquiry. The window is thought to be between 7 and 45 days.

Although the mortgage credit pull window isn’t an official rule straight from the credit bureaus, it’s a reliable guideline you can trust. Typically when a borrower is shopping and we pull their credit, it’s close to, if not exactly the same as what they saw from other lenders.

How to Shop for a Mortgage without Hurting Your Credit

Since you have a 45-day period of time in which you can apply with as many lenders as you want, make a plan ahead of time. Decide which lenders you’ll apply with before submitting your first application. Write down a list of questions for each lender.

» READ MORE: 4 Questions to Ask Every Mortgage Lender

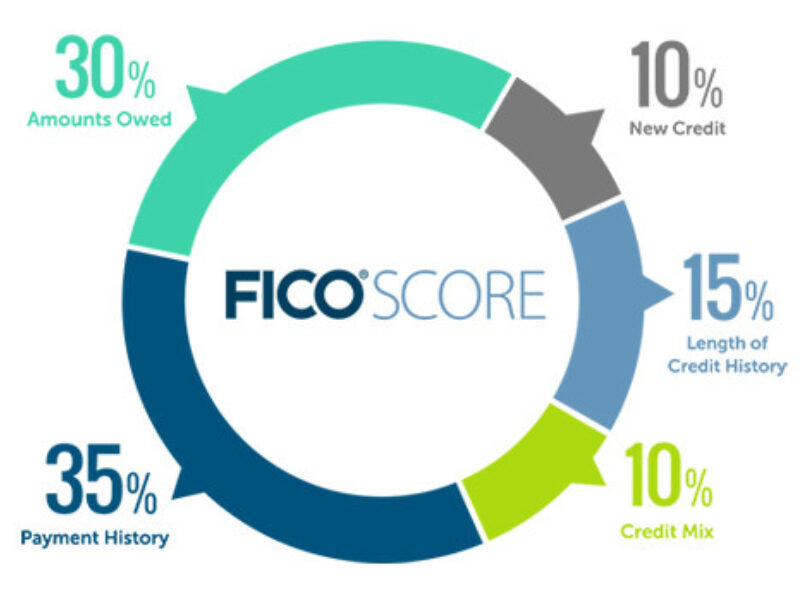

The FICO score does count inquiries, but it's one of the smaller pieces of the pie.Joanna Gaskin

•Vice President, FICO

Even if you continue applying after the 45-day window, your credit score won’t be heavily damaged. Joanna Gaskin, a vice president at FICO, reassuringly states that "The FICO score does count inquiries, but it's one of the smaller pieces of the pie. The inquiry is less than 10% of the weighting for your FICO score. One new credit inquiry likely won't cause much damage if you have a long history of borrowing, a solid payment record and a recent past without dozens of inquiries."

Your credit score has a heavy impact on the interest rate you get. Applying for a mortgage with multiple lenders won’t hurt your credit score nearly as much as these things will:

- Applying for other lines of credit (car loans, credit cards, personal loans) while shopping for mortgage lenders

- Missing monthly payments: credit cards, rent, child support, utilities, and other bills

- Reducing the average age of your lines of credit by closing credit cards

- Reducing your total available credit by spending more on credit cards and carrying a higher balance

Negative Item |

Score Decrease |

|---|---|

Bankruptcy |

up to 240 points |

Foreclosure |

up to 160 points |

Debt Settlement |

up to 125 points |

Late Payment |

up to 110 points |

Collection |

up to 110 points |

Hard Inquiry |

up to 15 points |

Multiple hard inquiries actually rank at the bottom of the list of actions that negatively impact your credit score.

Quick FAQs on how mortgage applications affect credit

How many points do mortgage inquiries affect credit score by?

You may see a loss of about 5 points. Sometimes scores are completely unaffected. Applying and/or being pre-approved for a mortgage doesn’t affect credit score in a significant way.

How many days do I have within the mortgage credit pull window?

The window is thought to be between 7 and 45 days. Try to contain your mortgage shopping within a couple of weeks.

How many mortgage lenders can I apply with?

Apply with as many lenders as you’d like. Multiple applications won’t affect your credit score as long as you’re shopping within the 45-day mortgage credit pull window.

The Bottom Line

You shouldn’t worry about hurting your credit score during the search for a great mortgage lender. Credit bureaus understand that it’s a normal part of purchasing a home.

That’s not to say that shopping for a mortgage is easy. Fortunately, your search ends with The Wood Group of Fairway. We serve first-time buyers, investors, families, and everyone in between.

- Seventeen physical locations

- Thousands of 5-star reviews

- The full suite of mortgage options

- The perfect mix of technology and human help

- Mortgage advisers that care for your loan like it's their own

Get started on your free pre-approval now. It only takes 90 seconds!