Article Excerpt

Calculate ROI, determine when your "break-even" point is, and important considerations for determining if buying a rental property is worth it for you.

Purchasing a rental property is no small decision. There are serious financial implications. As a first-time landlord, balancing risk and reward is key. How can you use a mortgage to get started as a real estate investor? Let’s take a look.

Calculation 1: Return-On-Investment

Return-on-investment, or ROI, is how you determine if a property is worth purchasing from a financial standpoint. It’s how much money you earn divided by how much you spend.

- Step 1: How much rental income do you expect to collect? This will require research in the local market. Try to find homes that are very similar to the one you’re purchasing: zip code, square footage, updated appliances and flooring, number of bedrooms, lot size, nearby amenities, garage space, etc.

- Step 2: How much will it cost to maintain? If you’ll have a mortgage, how much will your monthly payments be? How much are the HOA fees? How much of a down payment will you make? What about closing costs? Will your renters pay utilities? How much will property taxes increase by year-to-year, and will you increase rent to reflect that?

- Step 3: What’s your net operating income? Subtract the cost to maintain the property from your rental income. That’s your net operating income each month.

» READ MORE: What’s the Minimum Down Payment for a Mortgage?

Calculation 2: When will you start making a profit?

On the re-sell

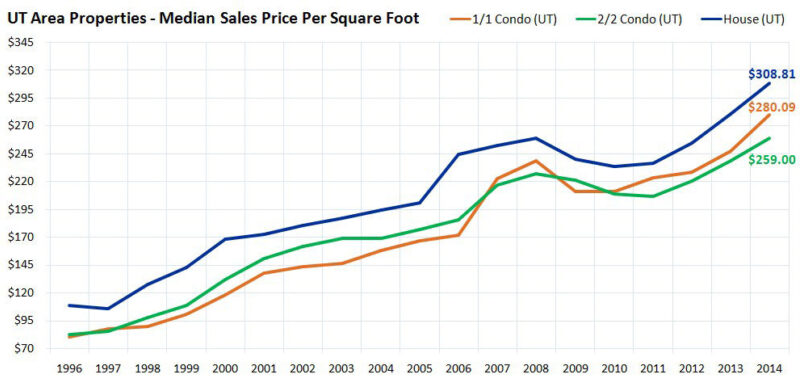

Image credit: Austinresidence.com

In growing markets, you may make a profit within a few years by selling the home due to rising home prices - even without making renovations.

Or, you purchase a little fixer-upper and improve its value. Although major fixer-uppers offer larger profit margins, they’re usually not recommended for novice real estate investors. It takes experience and a solid team to transform a house with big issues. Sometimes first-time investors find themselves in a money pit due to an over-ambitious project.

"Auctions are a great place to find investment properties as prices tend to be more competitively priced relative to the open market. The transaction times are also a lot shorter," comments James Durr, of Property Solvers, an auction house group in the UK.

After ‘x’ months of ownership

Remember, you not only have a monthly mortgage payment, but also a down payment and closing costs to recuperate.

The down payment/closing costs break-even point will be the month where you’ve collected enough net rental income to earn them back. For example: you spend a total of $15,000 on a down payment and closing costs. Your net rental income (with a mortgage) is $200 per month. After six years and three months, you will have earned your down payment back.

At this point, you’re truly earning $200 per month.

Is buying a rental property really worth it?

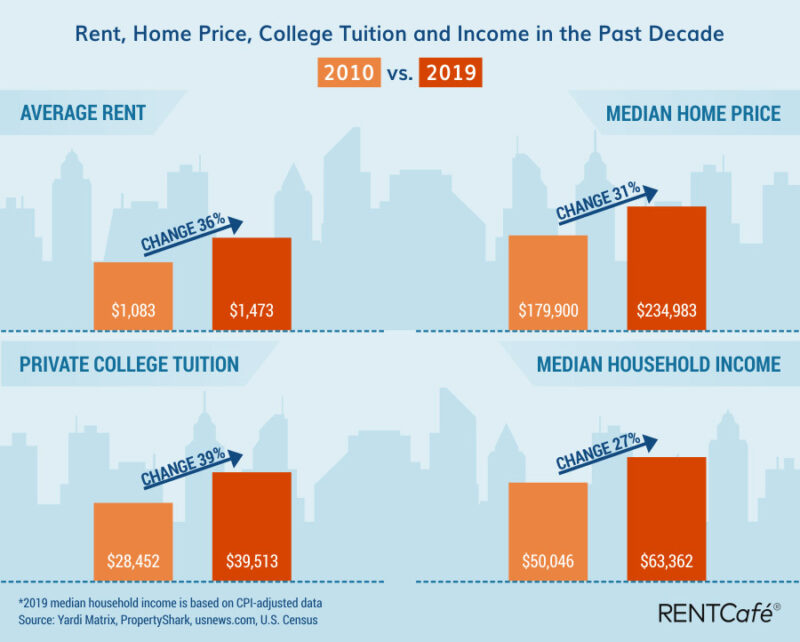

Image credit: Rentcafe.com

Many millionaires say real estate is still the best investment. But the answer may depend on what your goals are. If you’re hoping to earn a large amount of money in a short amount of time, you’re taking a risk with real estate. Although people will always buy land, markets do fluctuate.

Slowly building a smart real estate portfolio creates real, generational wealth. Saving money, purchasing in growing areas, treating renters with respect, and allowing yourself a cushion in case of vacancies is the smart, methodical way to go about being an investor.

Successfully flipping multiple properties and large-scale property management takes experience. Taking off more than you can chew often leads to financial burdens for first-time rental property owners. Newer real estate investors may consider looking into a real estate crowdfunding platform, like jatapp.com.

Renting out Your Primary Residence

Your primary residence is defined as the main dwelling where you live for at least six months out of the year. Multi-unit properties like duplexes would enable you to separate your personal living space from your renter. They also yield higher margins than a single-family home with the same square footage because the renter is afforded their own enclosed space.

One of the safest ways to begin your journey as a real estate investor is to rent out a room in your own primary residence. Some investors call this “house hacking.” Most people’s mortgage payment is their largest monthly expense. Cutting it down with a renter is a smart move.

When you purchase a home within your budget (as if you will have no renters), the pressure to find renters is lower. As you learn how to manage renters and set prices, your finances won’t be as stressed. Multi-month gaps between having renters and not having them won’t hurt as much either. All in all, renting out a room in your primary residence is a safe and flexible way to get started as an investor.

Don’t spend any of your rental income; save it for valuable home improvements and possibly for the purchase of another rental property. Slow and steady wins the race!

» READ MORE: Check out tax forms and information for rental properties

Ready to run some numbers?

At this point, you may have run through some calculations: how much can you afford? What are homes renting for in your area? Is it realistic to live with a renter?

Get the guidance you need from one of our many experienced mortgage loan officers. We’re located all across Texas in order to provide one-on-one advice. Your first step is getting started on a free pre-approval. See what you qualify for today.