Article Excerpt

Is it realistic to buy a house if you've damaged your credit score? Take a look at ways to improve your score and get approved for a mortgage!

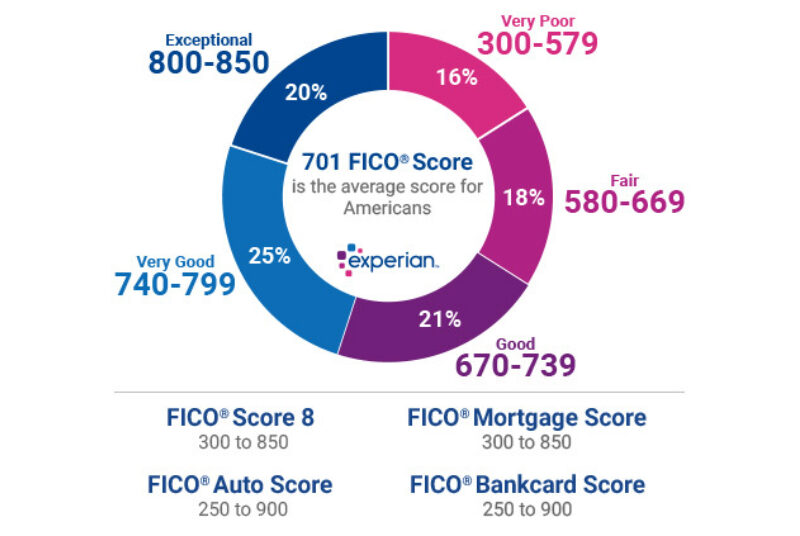

If you’ve made some credit mistakes in the past, don’t feel like you’re an extreme outlier. 34% of Americans hold a credit score at or below the “fair” mark. 16% of us are in the “poor” score range, which is below 579. And here in Texas, we owe an average of about $24,000 in non-mortgage credit.

Here’s the bad news: if your score falls below 580, you may not be able to qualify for a mortgage right now. But the good news is that with some time and discipline, you can get approved and become a homeowner. Let’s check out some ways to raise your score.

The most effective ways to raise your credit score

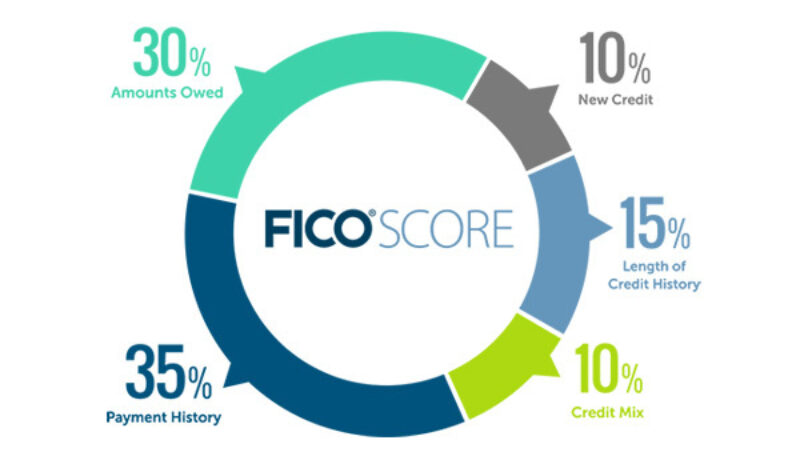

Different factors make up your score. Not all factors are weighted equally. If you want to raise your score as fast as possible, make sure the most important factors are satisfied first and foremost.

Make payments on time, every time!

The most important factor is your payment history. So how do you improve “history”? Well, you can’t erase past credit blunders. But from now on, if you continue to make payments on time, every time, your score will come up. Missing one single payment can set you back from reaching your goal and getting pre-approved to buy.

If you’re at risk of missing a payment, make a smart budget decision now. Prioritize your debt above all other spending. If you’re in a tough spot, it’s possible to negotiate payment due date extensions with credit card companies.

Watch your credit utilization

Amounts owed, or “credit utilization” described the amount of available credit you’re using. Ideally, the amount you owe on your accounts should be less than 30% of your available credit limits. So if you have a credit card with a limit of $1,000 and another credit card with a limit of $2,000, your amounts owed each month should be below $900. (1000 + 2000) x .30 = 900.

Don’t open new accounts

The third factor is based on the length of credit history. In other words, the average age of your credit cards affects your score. While there’s nothing you can do to increase the age of your average account, you do want to avoid opening new ones. Getting one more new credit card will drag your average age down, which may negatively impact your score.

Likewise, don’t close older accounts - even after paying them off. Closing old accounts will lower your average age. Leave the card open and use it periodically, paying it off in full each month. Plus, keeping a paid-off card lowers your credit utilization ratio.

Pay it off faster with a balance transfer offer

Transferring the balance of a high-interest credit card to another card with a lower interest rate can help shave down monthly payments. You’re basically paying off one credit card with another credit card. You can transfer from one credit card to another one you already own, or apply for a new credit card. Ideally, you’d transfer to a card you already own so as to not lower your average age of accounts, which is a factor in your credit score.

Balance transfers allow you to pay off debt faster, which lowers your overall credit utilization. Getting below the 30% utilization mark will definitely improve your credit score, especially if you’re sitting at 80%+ utilization.

Some credit card companies will charge balance transfer fees. But it doesn’t hurt to ask to have those fees waived. Don’t be afraid to negotiate a little bit - sometimes it’ll go your way! And even if you can’t get a fee waived, making the transfer may still save you money.

Balance transfer example scenario

If you owe $5,000 on a credit card with an interest rate of 24%, but you have another card at 14% with room to spare in its limit, you may have an opportunity to save money. Transfer as much of that $5,000 as possible on to the card with the lower interest rate.

Let’s say you want to pay off that $5,000 in two years. So you transfer all of it from the 24% card to the 14% card. Instead of spending $1,344 in interest alone during those two years (which is $56 per month), you’re now going to pay only $761 in interest, which saves about $24.29 per month. As you can imagine, the higher your debt, the more opportunity you have to save with a balance transfer.