Article Excerpt

The mortgage industry offers people many ways to buy a home, but it wasn’t always like this. Learn about how mortgages have changed over the years.

Today’s robust mortgage market only dates back to the 1930s and ‘40s when Congress passed laws promoting homeownership. It created government-backed programs that encouraged lenders to make mortgage loans and help people who might not otherwise be able to afford their own homes.

Let’s take a tour of mortgage history!

The Very Early Days of Mortgages

It’s uncertain when or where the idea of using real property to secure a loan used to purchase that property — i.e. a mortgage — originated.

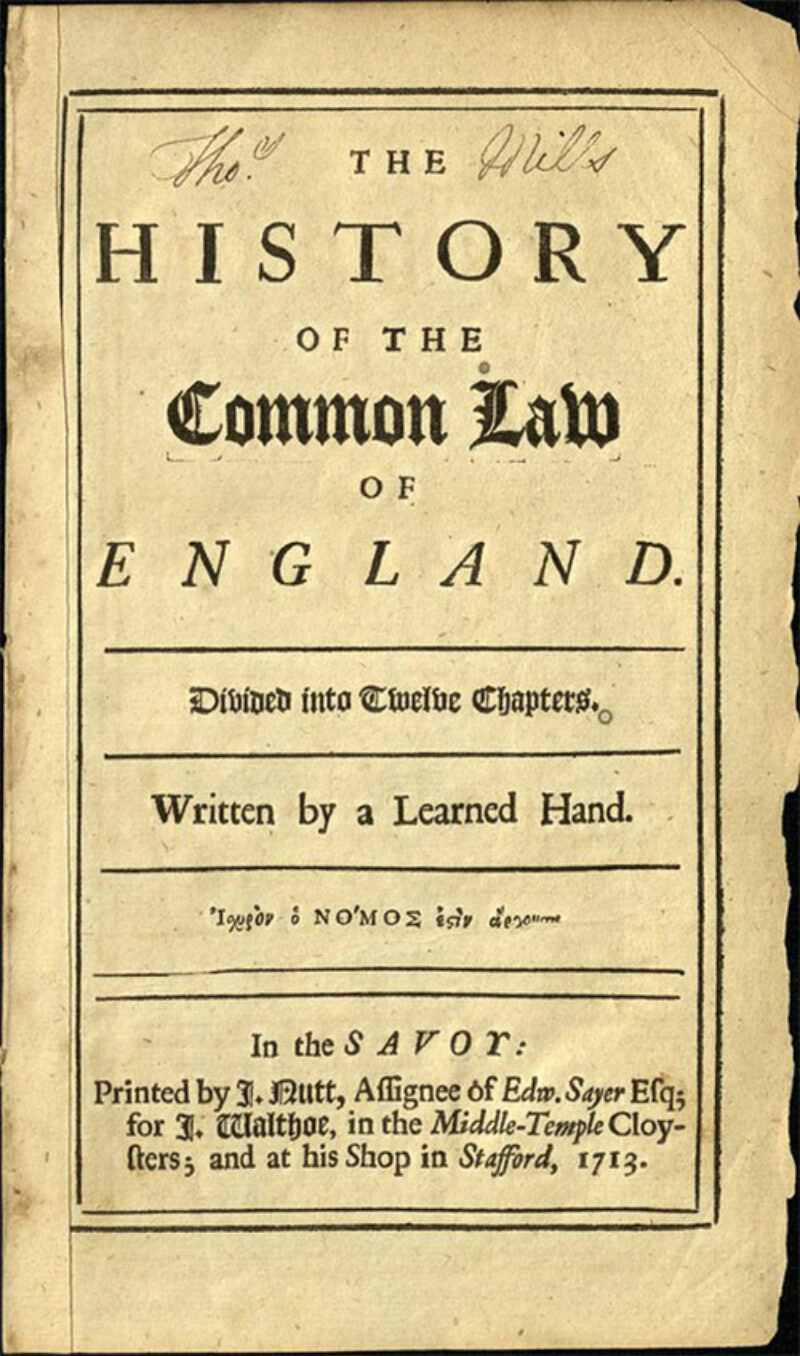

But one of the oldest, the Code of Manu, was a legal text written in India over two thousand years ago. It set limits on interest rates that lenders may charge and restricts what they may do in cases of default by borrowers. English common law, which forms the basis for much of the U.S. legal system, first mentioned the concept in the 12th century.

In some countries, your neighbors would help you build your own house - no mortgage needed! Then again, we’re talking about thatch roofs, mud floors, and certainly no A/C.

Photo via Flickr. Image credit: Yale Law Library.

The Roots of the Word “Mortgage”

The word “mortgage” comes to us from Old French around the 14th century. Mort means “dead,” and gage means “pledge.” “Mortgage” literally translates to “dead pledge,” since the promise to repay “dies” when either:

The borrower repays the debt; or

The borrower defaults and the lender forecloses on the property.

Any system of mortgages that existed in 14th-century England would not look very familiar to today’s homebuyers. Charging interest on loans became legal in the early 16th century, along with concepts like the borrower’s “right of redemption.” Changes like these gradually led to the development of the kinds of loans we would recognize.

Mortgages in the 18th and 19th Centuries

Prior to the 20th century, very little oversight existed for mortgages. Banks perhaps most commonly loaned money to farmers to buy land, but wealthy individuals and families could also borrow money to buy property.

This began to change in the mid-1800s. Banks began to make more loans to more common people to enable them to buy homes. Most of these changes occurred at the local level.

Abraham Lincoln was the sitting president when mortgage lending became widespread practice in the US.

The National Bank Acts, three laws passed by Congress from 1863 to 1865, helped set the stage for much more widespread mortgage lending. These laws created a national banking system for the first time in several decades. While the main reason for these laws was to secure a market for war bonds, they also helped to stabilize the U.S. dollar and expanded the reach of the banking system.

Mortgages from 1900 to 1938

Something resembling today’s mortgages began to emerge in the early 20th century. These mortgages, however, tended to have very short terms - often as little as five years, and no amortization.

» READ MORE: All About Mortgage Amortization

They required homebuyers to put up as much as half of the purchase price as a down payment! As far as interest rates went, banks often expected borrowers to renegotiate every year. This all began to change in the 1930s, when the Great Depression brought one of the first examples in modern U.S. history of the bursting of a housing bubble.

Led by President Franklin D. Roosevelt, Congress passed a massive amount of laws reforming the country’s financial system, collectively known as the New Deal. This included numerous laws affecting banks and mortgages. In 1934, Congress created the Federal Housing Administration (FHA) to protect both homebuyers and mortgage lenders. To this day, the FHA insures certain mortgages, which allows many more people to buy homes.

Mortgages from 1938 to 2008

Perhaps one of the biggest changes to the U.S. mortgage market occurred in 1938, when Congress created the Federal National Mortgage Association, more commonly known as Fannie Mae.

» READ MORE: What are Fannie Mae & Freddie Mac? What do They do?

This entity, which operates under the oversight of the FHA, buys mortgage loans from lenders and sells them to investors on a secondary market. This provides more cash for lenders so they can make more loans.

» READ MORE: FHA Loan Eligibility Requirements & Benefits

Photo via Wikimedia Commons

The Servicemen's Readjustment Act of 1944, also known as the G.I. Bill provided a wide range of benefits to people who serve in the U.S. military. This includes a mortgage loan guarantee program that helps veterans buy houses. Today, we refer to loans issued through this program as VA loans.

» READ MORE: VA Loan Eligibility Requirements & Benefits

The Housing Act of 1949 expanded the FHA’s authority to issue mortgage insurance to lenders. This spurred major growth in the mortgage market. Congress created the Government National Mortgage Association, or Ginnie Mae, in 1968 to help expand the availability of affordable housing. In 1970, it created the Federal Home Loan Mortgage Corporation, or Freddie Mac, to assist Fannie Mae’s efforts. In 1991, the U.S. Department of Agriculture (USDA) launched its loan assistance program for single-family residences.

This period had its difficult times, such as the savings and loan crisis of the 1980s. The overall trend was one of growth, though, at least until the subprime mortgage crisis began in 2007, and led us to the much larger recession that began the same year.

Mortgages from 2008 to the Present

The global recession of 2007 led to changes in the mortgage business. The same programs remain in place but a greater emphasis is now placed on making sure homebuyers understand all of the implications that come with borrowing large sums of money.

Find out more.

The mortgage industry of today offers people more opportunities to own a home than ever before. If you’re looking to buy a home, the Wood Group of Fairway can help. Get started on your free pre-approval today!