Article Excerpt

Learn about the advantages and disadvantages of building a home vs purchasing an existing one, including mortgage nuances for new construction purchases.

You have many options when it comes to buying a home. You can look at what is available among existing properties, or you can consider new construction. The category of “new construction” has its own subcategories. You might look at a new or growing subdivision, where new homes are going up based on specifications from a developer or homeowners’ association (HOA). Maybe an old house was torn down, and you want to build a new house where it stood.

You might be thinking about building a home on vacant land. In some cases, you will buy the land and the home at the same time. In others, you may need to buy the land and then pay for the home. In any of these situations, unless you’re paying completely from your own pocket, you will need financing.

Is it cheaper to buy an existing home or build a new one?

Unfortunately, that question has no easy answer. Realtor.com reports that, as of June 2022, the median cost of building a new home was $332,524, and the median cost of an existing home was $447,000. The National Association of Home Builders (NAHB), on the other hand, states that the median costs for the same time period to build a new home and buy an existing one were $428,300 and $420,900, respectively.

Whether you will pay more for a new home or an old one depends on more variables than we can list here. Location, which may include both the city or county and the specific building site, is perhaps the most important factor. The easiest way to do a cost comparison is to research the area where you want to build or buy.

Image by Wokandapix from Pixabay

What advantages do new and existing homes offer?

Advantages of an Existing Home

Financing an existing home offers at least one clear advantage over building a home: convenience. The home already exists. You can visit and inspect it. The mortgage process has many steps and can take some time, but through it all, you know that the home actually exists and that once you close on the sale you can move in. There is also a reduced chance of delays, which will affect the mortgage process.

New Construction Disadvantages

Building a new home can take much longer. On top of the time it takes to obtain a mortgage, it can face delays due to factors like weather, equipment problems, and availability of materials.

Delays in construction can add to your costs in more ways than just the cost of the new home itself. If you are selling your current home, for example, the buyer will expect to be able to move in regardless of whether your new home is ready or not. You will need a place to stay — and to store all of your stuff — in the meantime.

New Construction Advantages

The number one advantage that new construction offers is probably the ability to get the exact kind of home you want. You might have to abide by certain HOA rules, but you can have much more input into the layout and features of your new home. There may also be warranties offered from the builder.

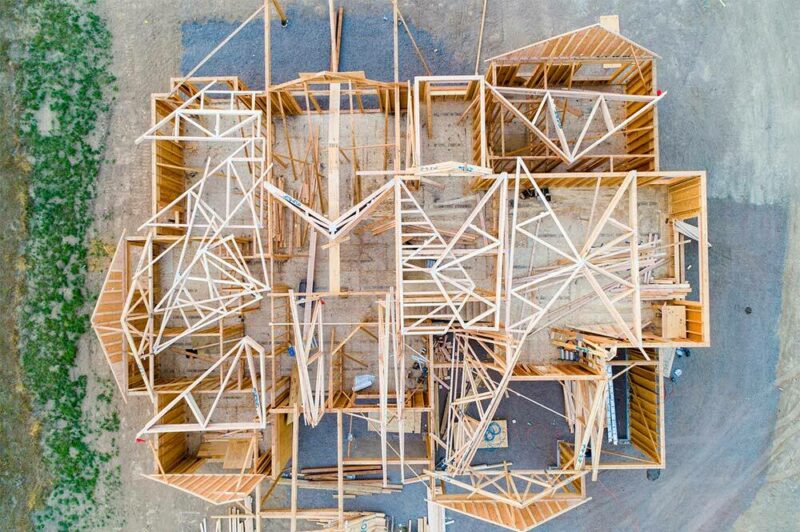

Photo by Avel Chuklanov on Unsplash

How do mortgages work for new construction vs. existing homes?

Mortgage financing for some new constructions works the same as mortgages for existing homes. When you buy an existing home, you are buying the home and the land on which it sits. If you are buying a home that is under construction in a new or growing subdivision, you can also buy both the land and the home as a package. Conventional mortgages and mortgages backed by the FHA, VA, or USDA enable you to buy a home this way.

Building a home without guidance from a developer or HOA can be trickier when it comes to mortgage financing, but you have options. You may need separate loans to buy the land and pay for the construction:

Land loan: This type of loan allows you to purchase vacant or undeveloped land. It is similar to a standard mortgage in many ways. The land serves as collateral for the loan, for example.

Construction loan: This is a short-term loan you can use to pay for the costs of building the home. You might only have to pay interest during the loan term. A construction loan usually comes due when construction is complete. You will need another source of financing to repay the principal of that loan. This is where a traditional mortgage comes in.

A traditional mortgage lender will only lend money for homes that actually exist. You probably will not be able to get a mortgage until construction reaches a certain stage, but once you get one, you can use the money to pay off the land and construction loans.

Photo by Erik Mclean on Unsplash

How do mortgage interest rate locks work for new construction?

A mortgage rate lock freezes the interest rate for a limited period of time. You are guaranteed that rate as long as you close before the lock expires.

In some situations, you may be able to get a mortgage rate lock that lasts for up to a year, or possibly longer. This gives you the reassurance that you will not lose a favorable interest rate because of delays in construction. Interest rates are currently rising, which makes a lock particularly desirable.

Longer locks typically carry larger fees, however. Read more about rate locks in our rate lock guide.

Step one: Understand your mortgage options!

Timing is critical as you build a new home. Your mortgage loan officer should be familiar with the new construction process. Get in touch with an advisor who looks out for your best interest at The Wood Group of Fairway. Start now with our easy online form!