Article Excerpt

You may be paying more than you have to on your mortgage. We’re going to walk you through the basics of refinancing: when, why, and how.

Why Refinance a Home Loan?

Refinancing your home can save you a good chunk of change throughout the remainder of your loan. It’s not quite as complicated as it may sound, and when done right, it pays off each month.

A cash-out refinance can give you cash from what you’re already paid for your home. That cash can be used for anything: paying student loans, hospital bills, a vacation, or anything else.

When’s the Best Time to Refinance?

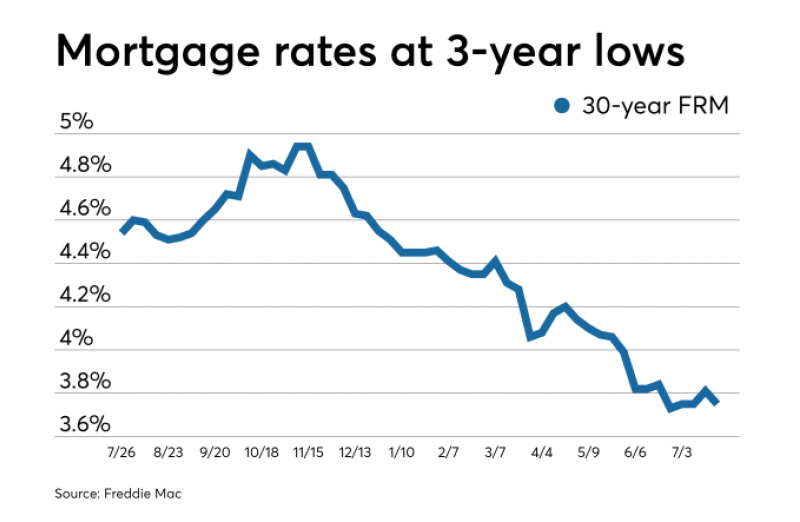

The best time to refinance is when mortgage rates drop below what your current rate is. There will be some up-front costs to get your loan refinanced, but the goal is to get out ahead in a couple years’ time.

There are more considerations that a loan officer can help you with:

- How long are you going to live in the home?

- How much equity have you built up?

- Is the rate going to drop?

- Have your property values increased?

Did you know, as of August 2019, rates are at their lowest in 3 years? This creates a refinance opportunity to save money each month!

How to Start a Refinance

Refinancing is done through a mortgage loan officer. The same loan officers that help homebuyers set up the purchase also help current homeowners to refinance. An experienced loan officer will be able to calculate whether you’ll save money by refinancing.

Get Started and Save Money

Now may be a great time to take advantage of fallen interest rates. Take our short questionnaire to find out how much you can save every month!