Article Excerpt

This past Sunday, the Federal Reserve made a near-zero rate cut. Will mortgage rates follow? Perhaps - but don’t bank on it.

We’re in a very unique time for mortgage rates. Since the first fed rate cut in 2020, we’ve seen historically low rates rise and tumble down again from week-to-week. This past Sunday, the Fed cut rates once again. Many prospective homebuyers would expect mortgage rates to follow, but it’s not quite that simple.

How have Fed rate cuts affected mortgage rates in the past?

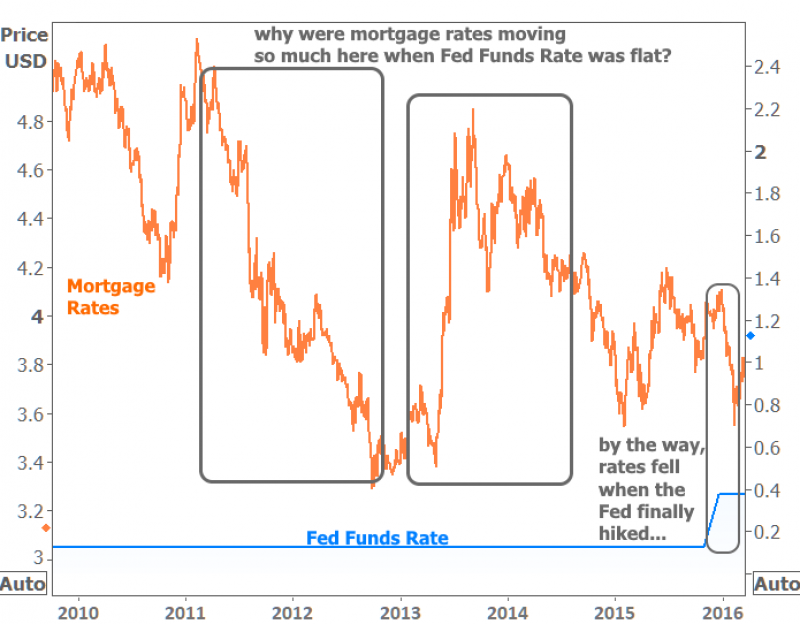

If we’ve learned anything about the relationship between Fed and mortgage rates, it’s that they’re separate from each other. They’re apples to oranges. Check out the movement in mortgage rates from 2010 to 2016 compared to the steadiness of the Fed funds rate.

Source: Matthew Graham at Mortgage News Daily

As shown, mortgage rates fluxed from the 5’s to 3’s in this time span, even when the Fed funds rate stayed flat.

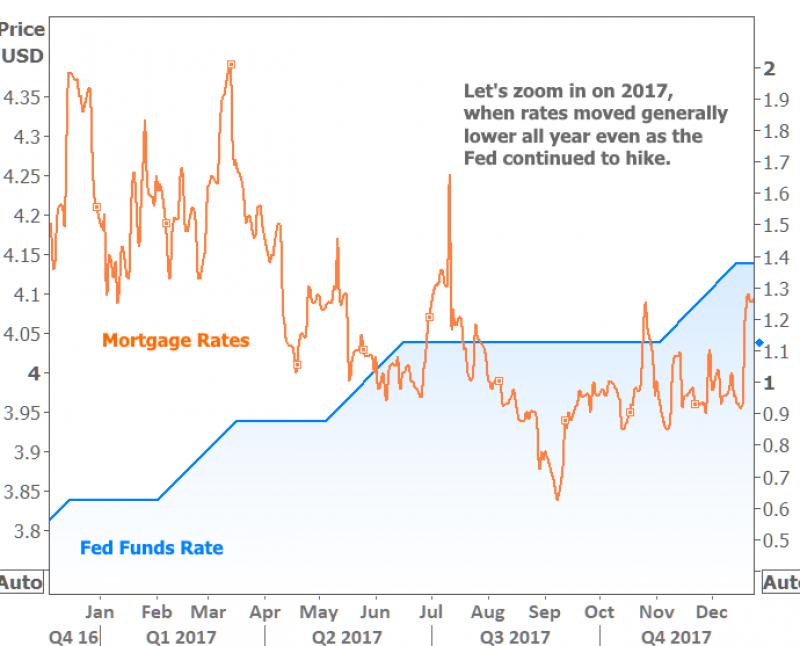

Now let’s look at a different pattern from 2017. As the mortgage rate’s trend line takes a general move downward, the Fed funds rate climbs upward.

When you pair historical data with the uncertainty of our current market, the only safe assumption for the future of mortgage rates is that there are no safe assumptions at all!

Quick Facts

Here’s what you need to know about how the Fed rate cut relates to mortgage rates:

- Mortgage rates are not at zero, and do not mirror the Federal Reserve rate cut.

- A Federal Reserve rate cut is a short term, overnight bank-to-bank lending rate which does not have a direct impact on mortgages.

The Fed Funds Rate applies to loans with a term of up to 1 day (essentially last minute money shuffling between banks)... Mortgages, of course, can be loans of up to 30 years.Matthew Graham

•COO at Mortgage News Daily

- This cut will lower rates on credit cards, home equity loans, auto loans and other consumer loans that are affected by the “prime” rate. The prime rate is greatly affected by the Federal funds rate.

- Mortgage rates are based on the MBS (mortgage backed securities) market. The MBS market is independent from the treasury bond and the stock markets.

Key Takeaways

We can’t predict the future. Ongoing developments with the COVID-19 situation, federal policy, trade negotiations, and the 2020 presidential election will all play a part in where rates head to next.

If you’re in the market for purchasing a home: make sure your mortgage adviser has everything they need to lock your loan at the right time. With rates changing from week-to-week, or even day-to-day, you need to be ready to make the decision when the time is right.

Let’s find out what you qualify for today. Get started with the mortgage lender Texans trust!